Done right, a compliance report is more than paperwork. It’s a tool that builds trust with regulators, informs your leadership, and strengthens your operations. Done poorly, it’s just a pile of jargon that no one reads.

In this guide, we’ll walk you through how to create a high-impact compliance report—one that’s clear, helpful, and gets people to act.

What is Compliance Reporting?

Compliance reporting is how a company shows that it’s following the rules. These rules could come from the government, industry standards, or the company’s own policies. A compliance report is a written document that explains:

- What was checked?

- What is the company doing right?

- Where improvements are needed?

It helps keep the business safe from legal trouble, builds trust with customers and regulators, and makes sure everyone is doing things the right way.

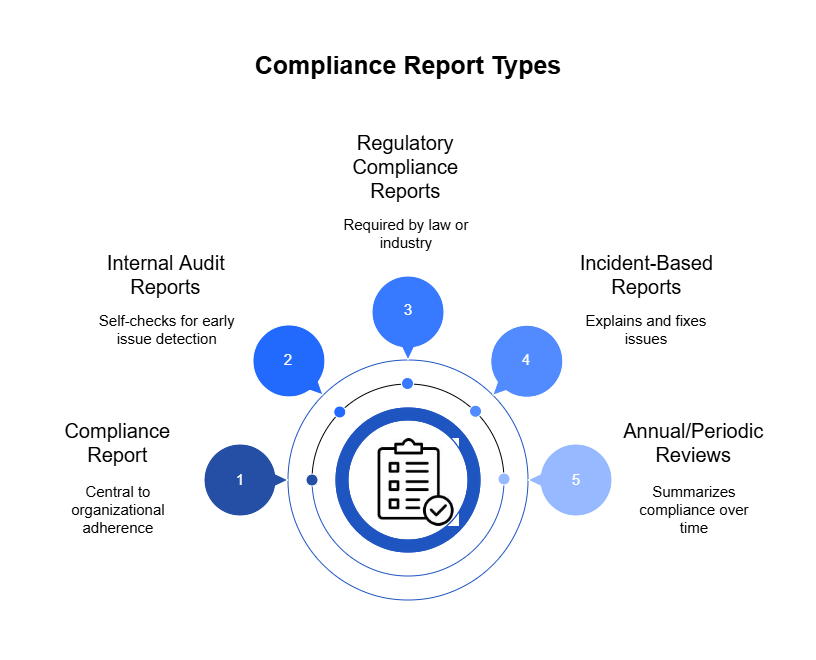

Types of Compliance Reports

Just like there isn’t one kind of health check-up, there’s no one-size-fits-all compliance report. The type of report you create depends on who it’s for, what it’s covering, and why you’re doing it in the first place.

Here are some of the most common types of compliance reports you might need to prepare—and what makes each one useful:

1. Internal Audit Reports

These are your organization’s self-checks. Internal audit reports help you catch issues before they become big problems. They’re often used by leadership teams or compliance officers to stay on top of internal policies, procedures, and risk areas.

Example:

A quarterly internal audit reviewing access controls to ensure only authorized employees can view sensitive customer data.

2. Regulatory Compliance Reports

These reports are usually required by law or by an industry regulator. They show that your organization is following specific rules—whether that’s related to data protection, finance, health and safety, or environmental standards.

Example:

A GDPR compliance report submitted to a data protection authority detailing how personal data is collected, stored, and protected.

3. Incident-Based Reports

When something goes wrong—like a data breach or a policy violation—you may need to create a report that explains what happened, why it happened, and what you’re doing to fix it.

Example:

A post-incident report following a cybersecurity attack, documenting the breach and steps taken to prevent it in the future.

4. Annual or Periodic Compliance Reviews

These are big-picture reports that provide a summary of your compliance posture over a longer period—typically a year. They’re useful for board meetings, strategic planning, and benchmarking your progress.

Example:

An annual report reviewing company-wide compliance with workplace safety standards, including training participation and incident trends.

5. Thematic or Department-Specific Reports

Sometimes, you need to focus on a specific area—like vendor risk, financial transactions, or employee training. These targeted reports help dive deeper into one part of your compliance program.

Example:

A vendor compliance report evaluating whether third-party partners meet your organization’s cybersecurity and privacy requirements.

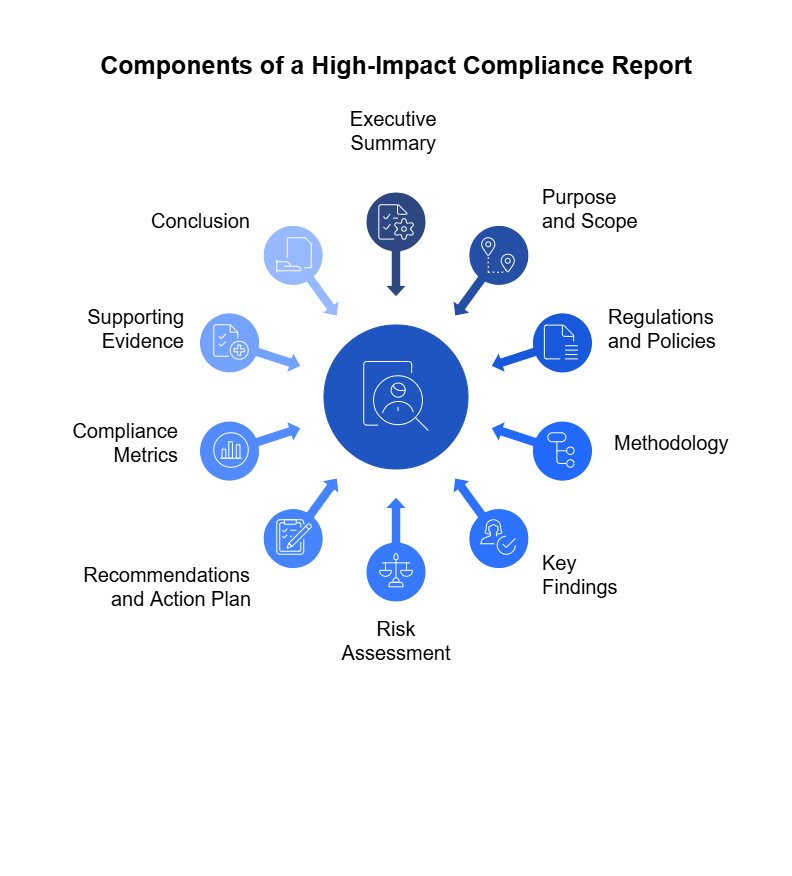

What to Include in a High-Impact Compliance Report

Creating a compliance report isn’t just about ticking boxes—it’s about building trust, reducing risk, and showing that your organization takes its responsibilities seriously.

In fact, a recent study found that companies with mature compliance programs are 42% less likely to experience a regulatory violation compared to those with ad hoc or reactive approaches.

To be truly useful, your report should be easy to understand, focused on action, and backed by data. Here’s a breakdown of the key elements every high-impact compliance report should include—plus how to make each part meaningful.

1. Executive Summary

Think of the executive summary as the trailer to your report—it doesn’t reveal everything, but it gives just enough for someone to quickly understand what’s going on. This section should be short, sharp, and to the point, especially for senior leaders or stakeholders who may not have time to read the entire document.

A strong executive summary answers three key questions:

- What was reviewed?

- What were the major findings?

- What needs to happen next?

What to include:

- Time period covered – Was this a quarterly audit, annual review, or incident-specific report?

- Focus areas – Which teams, processes, or policies were evaluated?

- Overall compliance status – Use a percentage, traffic light rating (e.g., green/yellow/red), or short summary.

- Key risks or highlights – Mention any critical issues or areas of excellence.

- Next steps – What actions are being taken or recommended?

Why this matters:

Executives and board members often make strategic decisions based on summaries. A well-crafted executive summary ensures they’re informed without having to dig through the details. Plus, it shows that your team understands the big picture and isn’t just “auditing for auditing’s sake.”

Example:

This report covers Q1 2025 and evaluates the company’s compliance with internal data privacy policies and GDPR requirements across customer service operations. We found a 92% overall compliance rate. Two medium-risk gaps were identified related to consent documentation and third-party data access. Immediate remediation is in progress and expected to be completed by June 2025.

Pro Tip:

Avoid technical jargon. Keep this section readable by someone with no compliance background. Focus on clarity over complexity.

2. Purpose and Scope

Before diving into the findings, your readers need to understand why this report was created and what it actually covers. The purpose and scope section sets the stage—it helps avoid misunderstandings, frames expectations, and provides important context.

Think of it like a map legend: it tells people what area you’re reviewing, why you’re reviewing it, and what’s intentionally out of bounds.

What to include:

- Why this report was created:

Was this a routine audit? A response to a new regulation? An investigation following an incident? - Which teams, locations, systems, or business processes were reviewed:

Be specific—if you reviewed only customer support teams or only certain vendors, say so. - What frameworks or standards apply:

Mention if this audit is tied to GDPR, HIPAA, ISO 27001, SOC 2, or company-specific policies. - What’s not included (optional, but helpful):

Clarifying the boundaries avoids confusion later on. If sales or finance teams weren’t part of this review, it’s good to mention it.

Why this matters:

Without a clear scope, your audience may assume the report covers areas it doesn’t—or miss why certain details matter. This is especially important when multiple teams or compliance areas are involved.

Example:

This report was developed as part of our Q2 2025 internal audit cycle and focuses on personal data handling practices within the customer support and CRM operations for the Indian market. The audit evaluates compliance with the Digital Personal Data Protection Act (DPDPA), 2023—specifically focusing on consent management, purpose limitation, and data retention. This review does not include product analytics or third-party processors, which are scheduled for assessment in Q3.

Pro Tip:

Be precise, but keep the language simple. If your audience includes non-technical readers, avoid acronyms unless you explain them. This section is your chance to make the report approachable and easy to follow from the start.

3. Regulations and Policies Reviewed

Every compliance report needs a solid foundation. That foundation is the set of rules, laws, and internal policies your audit is based on. This section answers the question: What exactly are we measuring compliance against?

Think of it like grading a test—you need to know what syllabus was used to set the questions.

What to include:

- Relevant laws and regulations:

Name the specific laws or frameworks that apply to the area you’re reviewing. These could be local (like DPDPA), international (like GDPR), or industry-specific (like HIPAA or PCI-DSS). - Internal policies or codes of conduct:

If your company has its own standards—such as data handling rules, access control procedures, or vendor management protocols—list them here. - Any contractual or client requirements:

If certain customers or partners require you to follow specific practices, mention those too.

Why this matters:

Stating the regulations up front shows that the audit was grounded in clear, authoritative guidelines. It also helps stakeholders understand why certain findings are important and what risks non-compliance could trigger. This is especially valuable for legal and leadership teams.

Example:

This review was conducted under the framework of the Digital Personal Data Protection Act (DPDPA), 2023, with a focus on Sections 4 (Consent), 6 (Data Fiduciary Obligations), and 9 (Data Retention). In addition to the law, the audit applied the company’s Data Governance Policy (v2.1), the Customer Consent Management SOP (v1.0), and specific requirements outlined in our enterprise client contracts regarding data localization and access transparency.

Pro Tip:

If the audience for your report isn’t familiar with the laws mentioned, consider adding a short description or including a glossary in the appendix.

4. Methodology

This section is all about transparency—explaining how you conducted the compliance review. It gives your report credibility by showing that the findings weren’t based on assumptions or opinions, but on a structured, repeatable process.

Think of this like showing your work in a math problem. It helps others trust your results.

What to include:

- Data sources:

What information did you review? This could include system logs, employee records, email workflows, data storage configurations, or consent records. - Tools used:

Mention any software platforms or automation tools (like Spog.AI) that helped collect, monitor, or analyze the data. - How the review was conducted:

Was it a manual audit? Were interviews or surveys conducted? Did you sample certain departments, geographies, or user groups? - Timeframe of the review:

Specify when the review was carried out and what time period the data covers.

Why this matters:

A well-documented methodology shows that your process is thorough, objective, and repeatable. It also helps other teams replicate or verify the review later—whether it’s an internal audit, regulator follow-up, or future compliance check.

Example:

The audit was conducted from April 10–30, 2025, and focused on customer data collected between January 1 and March 31, 2025. Data was collected from the CRM system, employee onboarding logs, and the consent management platform. We used Spog.AI to automatically scan for access control violations and reviewed training completion reports from the HR system. Interviews were also conducted with data handlers in the customer support and marketing teams to understand how policies are applied in day-to-day operations.

Pro Tip:

If you used sampling—like reviewing only a portion of records or departments—be sure to explain why and how you chose that sample. It shows thoughtfulness and avoids giving a false impression of 100% coverage.

5. Key Findings

This is the heart of your report—the part most readers are looking for first. It answers the big question: What did we discover?

Your findings should be presented in a way that’s easy to scan, understand, and act on. Highlight both what’s working and what’s not, and don’t bury the critical issues. This is where your report moves from being informative to impactful.

What to include:

- What was assessed and what was found:

Clearly list each area reviewed and whether it was compliant, partially compliant, or non-compliant. - Use plain language:

Avoid jargon. Say things like “No evidence of consent collected for users in India” rather than “DPDPA Article 4(2) non-conformance.” - Call out severity:

Use labels or color codes (e.g., green/yellow/red) to make it easy to spot critical issues. - Balance the positives and negatives:

Don’t focus only on what went wrong. Highlight where the organization is doing well too.

Example Table:

| Area Reviewed | Status | Notes |

| Consent Management | Non-Compliant | No audit trail for user consent collected in January (DPDPA Sec. 4) |

| Access Controls | Compliant | All active employees have MFA enabled |

| Data Retention Practices | Partially Compliant | Legacy customer data exceeds 12-month retention window |

| Training Completion (Q1) | Compliant | 98% of required employees completed training on time |

6. Risk Assessment and Business Impact

Not all compliance issues are created equal. Some might be minor oversights with little real-world impact, while others could lead to major legal trouble or loss of customer trust. This section helps your audience understand the difference.

A good risk assessment explains how serious each issue is and what the consequences could be. That context is what helps teams prioritize the right fixes—and act fast when needed.

What to include:

- Risk level for each issue:

Use a simple scale (Low, Medium, High) or visuals like traffic lights (Green/Yellow/Red). - Potential consequences:

Explain what could happen if the issue isn’t fixed—think legal penalties, operational disruptions, financial loss, or damage to your reputation. - Likelihood of occurrence:

If relevant, mention whether this is a rare gap or part of a larger pattern. - Affected stakeholders:

Who might be impacted? Customers, employees, regulators, partners?

Example Table:

| Issue | Risk Level | Business Impact | Action Required |

| Missing user consent records | High | Non-compliance with DPDPA could lead to legal action and fines; undermines user trust | Immediate remediation required |

| Outdated data retention SOP | Medium | Potential for holding unnecessary personal data, leading to audit flags | Update SOP within 30 days |

| Training gap (2 new hires) | Low | Limited impact; addressed during onboarding this month | Monitor next training cycle |

Pro Tip:

Where possible, connect risks to real-world outcomes. For example: “Similar violations under GDPR have resulted in €20M fines for comparable companies.”

If your organization uses a risk register or heatmap, this is a great place to include a visual summary of current risks.

7. Recommendations and Action Plan

After identifying the problems and understanding the risks, the next logical step is: What do we do about it?

This section turns your findings into a plan. It lays out exactly what needs to happen, who needs to do it, and when it should be done. A clear, well-organized action plan ensures your report doesn’t just sit in an inbox—it actually drives change.

What to include:

- Recommended actions:

For each issue or gap, suggest specific, practical steps the organization can take to fix it. - Responsible owners:

Assign each action to a team or individual to ensure accountability. - Deadlines or target dates:

Set a reasonable timeline for when each task should be completed. - Priority levels:

Use tags like High/Medium/Low to help teams focus on the most urgent issues first. - Status (if this is a follow-up report):

Track whether previous recommendations have been completed, are in progress, or still open

Example Action Plan Table:

| Issue | Recommended Action | Owner | Due Date | Priority |

| No audit trail for consent | Implement logging feature in CRM | IT + Legal | June 15, 2025 | High |

| Legacy data exceeding retention | Purge outdated records and update retention policy | Data Governance | May 30, 2025 | Medium |

| Training gap for new hires | Enroll employees in onboarding compliance module | HR Compliance Team | May 25, 2025 | Low |

Pro Tips:

- Keep the action steps realistic—recommend solutions that are feasible within the organization’s resources and systems.

- Avoid vague fixes like “review process” or “improve controls.” Instead, say what needs to change, how, and by whom.

- Consider including a timeline graphic if there are many steps or overlapping projects.

8. Compliance Metrics

If the findings and action plan tell the story, metrics are the proof. They give your report weight by showing how the organization is performing over time—and where improvement is needed.

Whether you’re tracking employee training, policy adherence, or issue resolution rates, these numbers help you measure impact, spot trends, and demonstrate accountability.

What to include:

- Training completion rates:

What percentage of employees completed mandatory compliance training on time? - Policy adherence metrics:

Are teams following documented procedures? How often are violations reported? - Incident response time:

How quickly are compliance issues identified and resolved? - Remediation progress:

What percentage of action items from previous audits are closed? - Audit pass/fail rates:

How many internal checks were passed without issues?

Why this matters:

Metrics make your report tangible. They help leadership understand the scale of issues and the results of past efforts. And they support informed decision-making for future compliance planning.

Example Metrics Table:

| Metric | Target | Actual (Q1 2025) | Status |

| Employee data privacy training | 100% | 96% | On Track |

| Consent record accuracy (CRM) | 100% | 82% | Needs Improvement |

| Issues closed within 30 days | ≥90% | 87% | Slight Delay |

| High-risk violations identified | 0 | 1 | Alert |

Additional Examples:

- Time to detect compliance violations: 5 days (average)

- % of policies reviewed in past 12 months: 92%

- Audit cycle completion rate: 100% for Q1

9. Supporting Evidence and Documentation

Your compliance report is only as strong as the proof behind it. This section provides the backup—the data, documents, and records that support your findings and recommendations. It’s where you show that everything in the report is based on facts, not opinions.

Think of it as the appendix of your report, but smarter and more purposeful.

What to include:

- System logs and access records

To validate security controls, user access, and data management practices. - Training reports and attendance logs

To confirm that employees completed required courses or certifications. - Policy documents and version history

To show alignment with internal guidelines and prove updates were made. - Screenshots or audit tool outputs

Especially useful when referencing software systems or dashboards (e.g., showing an unencrypted backup setting or failed security alert). - Interview summaries (if used)

Brief notes from key stakeholder interviews that helped shape your findings. - Checklists or assessment rubrics

Used to evaluate compliance against specific controls or requirements.

Why this matters:

Supporting documentation adds credibility. It not only helps readers trust your conclusions but also prepares you in case of an external audit or follow-up review. It demonstrates transparency, thoroughness, and readiness.

Example References Section:

Appendix A: Screenshot of CRM missing consent checkbox

Appendix B: February 2025 training completion report from HR portal

Appendix C: Internal Data Handling Policy v2.1 (effective January 2025)

Appendix D: System-generated access log for customer support tools

Appendix E: Interview summary with IT Security Lead on March 18, 2025

Pro Tips:

- Organize by topic or section: Group your evidence to match the structure of your report. It makes it easier to cross-reference.

- Keep sensitive data secure: Redact personally identifiable information (PII) or customer data before including screenshots or logs.

- Link to digital files (if shared online): Use hyperlinks to Google Drive, SharePoint, or your compliance tool for quick access.

10. Conclusion

A strong conclusion brings your compliance report full circle. After all the findings, analysis, and action plans, this section ties everything together—summarizing where things stand and what comes next.

Think of it as the closing conversation. You’re not just ending the report—you’re helping your audience walk away with a clear understanding of what matters most and where to focus.

What to include:

- Overall compliance status:

Offer a brief summary of how the organization performed. Was compliance strong overall? Were there critical issues? Use plain language and keep it neutral. - Key risks or takeaways:

Remind the reader of the most pressing issues without rehashing the entire report. - Next steps:

Outline what happens now—whether it’s a follow-up audit, a remediation check-in, or a policy review. - Timeline for review:

When will the next report be issued? What should be completed before then?

Why this matters:

The conclusion is your last chance to focus attention. It keeps the report from feeling like a checklist and instead turns it into an active, evolving part of your company’s compliance strategy.

And remember, compliance is never “done”—it’s ongoing. A thoughtful conclusion reinforces that mindset.

Example:

Overall, the audit shows that the organization is making strong progress in key areas of data protection and regulatory compliance, achieving a 94% adherence rate with only one high-risk gap identified. The most critical issue—missing consent tracking in the CRM—has been acknowledged and remediation is already underway. The compliance team will conduct a follow-up review in Q3 2025 to ensure all recommended actions are completed and fully embedded. Future reports will also expand coverage to third-party vendor compliance, as outlined in the 2025 compliance roadmap.

Pro Tip:

If your audience includes executives or board members, this is a great place to include a short “compliance score” or visual summary (e.g., a dashboard snapshot or traffic-light rating).

Step-by-Step Process of Compiling a Compliance Report

Writing a great compliance report isn’t just about knowing what to include—it’s also about how you bring it all together. A structured process helps you stay organized, cover all the right areas, and avoid last-minute scrambling.

Here’s a clear, step-by-step workflow you can follow to compile a high-impact compliance report from start to finish:

Step 1: Define the Purpose and Scope

Start with the why and what. Clarify:

- Why are you creating this report? (Routine check, regulatory requirement, post-incident review?)

- What part of the organization does it cover? (Which teams, systems, locations?)

- Which laws, standards, or internal policies are relevant?

Tip: The more specific you are here, the easier it is to keep the report focused.

Step 2: Gather the Right Data

Compliance reporting is only as good as the data behind it. Begin collecting:

- System logs, user access reports, and audit trails

- Policy documents and version histories

- Training records and participation data

- Past compliance reports for context

- Evidence from tools like Spog.AI, HR systems, or GRC platforms

Tip: Don’t wait until the writing phase to gather documents. Start organizing them early in folders or project boards.

Step 3: Conduct the Audit or Review

Use a clear methodology:

- Run automated scans (e.g., for data retention, consent, MFA, etc.)

- Interview key stakeholders where needed

- Manually review policies, processes, or compliance artifacts

- Use checklists or rubrics to rate performance consistently

Document everything. Even if something looks fine, make a note that it was checked and passed.

Step 4: Identify Issues and Analyze Risks

Go through your findings and flag:

- Areas of non-compliance or partial compliance

- Repeated or unresolved issues from past audits

- Risks related to data exposure, legal consequences, or business continuity

Assess each issue’s risk level and potential impact. Use simple, honest language.

Step 5: Develop Recommendations and an Action Plan

For each issue, outline:

- What needs to be fixed

- Who should own the fix

- When it should be done

- Any tools or resources required

Tip: Prioritize based on risk and feasibility. Focus on changes that will have a meaningful impact.

Step 6: Write the Report

Structure the report using the key sections we’ve already covered:

- Executive Summary

- Purpose and Scope

- Regulations and Policies

- Methodology

- Key Findings

- Risk Assessment

- Recommendations

- Compliance Metrics

- Supporting Documentation

- Conclusion

Use tables, charts, and bullet points to make the content easy to scan. Be clear, not wordy.

Step 7: Review and Validate

Before publishing:

- Double-check your data and facts

- Get a second pair of eyes (peer or manager review)

- Confirm action items and due dates with responsible teams

Optional: Run the report by Legal or Risk teams for input—especially if it’s going to external regulators or clients.

Step 8: Share the Report and Track Progress

Distribute the report to the right people: leadership, compliance owners, stakeholders, and—if needed—regulators.

Set up:

- Follow-up meetings

- Task trackers or dashboards to monitor remediation

- Timelines for future reviews or audits

Automating Compliance Reporting with Spog.AI

Most teams spend too much time pulling data from different systems, formatting spreadsheets, and chasing updates before they can even start writing a compliance report. This manual process slows everything down and leaves room for mistakes.

Spog.AI changes that. It connects with your company’s tools—like HR platforms, CRMs, help desks, and cloud storage—and brings all the right information into one place. You don’t need to dig through emails or request files from five different departments. Spog.AI does the heavy lifting. It tracks training completions, flags missing consent records, and even checks if your access controls follow the rules—all in real time.

But it doesn’t stop there. Spog.AI can generate reports for you using pre-set templates tailored to your needs. It includes risk summaries, action items, and live compliance scores—without you typing a word.

When something needs fixing, it assigns tasks, sets deadlines, and follows up with the right people. Everyone knows what they’re responsible for, and you can track progress without sending a single email. You also get a clear audit trail, ready for any inspection or internal review.

In short, Spog.AI takes the stress out of compliance reporting and helps your team stay ahead of issues—not just react to them.